Within this publication i’ve visited the brand new detail to the everything you incentives, however may indeed provides a quick matter. For the greatest promotions, to help you simple tips to claim him or her, listed here are our short and you can nice solutions to the most common issues. Along with old-designed banking actions, the new increase on the cryptocurrency betting has generated a different method to have on the internet bettors. If you’ve been contributing to KiwiSaver for around three-years, you are permitted withdraw your own deals (making a minimum balance from $1,000) to strengthen the deposit fund. It is very important remember that when you are Kāinga Ora establishes the newest eligibility conditions, acting lenders might have additional credit standards, such as examining your ability so you can provider the loan, contrasting your credit score, and provided your general financial situation.

Withholding International Partnerships (WPs) – 10000 Wishes casino

A different company one directs a USRPI must withhold an income tax comparable to 21% of the gain they recognizes to your delivery to help you its investors. No after 10000 Wishes casino than just ten months pursuing the import, a great transferee (apart from a partnership which is an excellent transferee since it produced a shipment) have to approve for the connection the new the total amount that it offers met its withholding duty. See Legislation part 1.1446(f)-2(d)(2) on the paperwork required for making it qualification.

- Furthermore, you might discover an enthusiastic NRO FD membership inside the India only using financing while it began with the world.

- The newest taxation withheld and you can earnings is reportable for the Models 1042 and you may 1042-S.

- The brand new dedication of one’s months that the newest compensation try attributable, to own purposes of choosing its resource, is founded on the main points and you will points of each situation.

- An expense paid back in order to a foreign payee on the provision away from a hope out of indebtedness granted just after September 27, 2010, is generally subject to section step 3 withholding.

- Tata AIA Life insurance Organization Limited will send your reputation to the new products, characteristics, insurance policies possibilities, existing plan otherwise relevant suggestions and you can/otherwise techniques your details in accordance with Privacy.

- You should, but not, trust your own genuine education if doing so contributes to withholding an expense greater than manage pertain within the expectation regulations or in the revealing an expense who does not susceptible to reporting underneath the assumption legislation.

Withholding Overseas Trusts (WTs)

Find Conditions of knowledge to possess Reason for Part 4, afterwards, on the need to know conditions one sign up for section cuatro objectives. The fresh terms discussed lower than lower than USVI and American Samoa firms have a tendency to apply at Guam or CNMI firms when an applying arrangement are in effect amongst the United states and therefore area. A different corporation is certainly one that does not complement this is out of a domestic business. A domestic company is one which was written otherwise structured inside the the usa or within the legislation of your own Us, any one of their says, or perhaps the District out of Columbia.

NR deposits on the Bank in the India aren’t insured by the all other insurance provider otherwise corporation exterior India and they are payable here at the new branch of the Bank in the Asia the spot where the put is created. The insurance coverage readily available is perfectly up to a total of One lakh provided with India’s Deposit Insurance rates and Borrowing Make certain Company. A foreign body’s a good nonresident alien individual, otherwise a foreign firm who has not provided an election below part 897(i) to be addressed as the a domestic company, foreign relationship, international believe, or international estate. It will not are a citizen alien individual or, at times, a professional foreign your retirement fund. A great transferee’s withholding out of tax less than section 1446(f)(1) doesn’t relieve a foreign individual away from submitting a great You.S. tax go back with regards to the import.

Lender of The united states

Come across Laws and regulations area step one.1446(f)-4(c)(2)(ii) for further information on a modified amount understood. For an expense knew paid to help you a good transferor that’s an excellent grantor trust, an agent could possibly get likewise dictate their withholding taking into consideration people withholding exclusion relevant so you can a great grantor or proprietor from the believe. A great WP or WT must provide your having a form W-8IMY you to definitely certifies the WP or WT try acting inside the one capability and offers all other information and you may certifications required by the proper execution, in addition to the WP-EIN otherwise WT-EIN. Once you create an excellent withholdable commission so you can a great WP or WT, the fresh WP otherwise WT essentially may also offer a certification out of a part cuatro reputation enabled of a great WP otherwise WT (and you can GIIN, if relevant). A section 4 withholding rates pond also means a cost of an individual sort of income which is spent on You.S. payees when the WP has the certification necessary to your Mode W-8IMY to have allocating money to that pond. The new before phrase applies with regards to a solution-because of beneficiary or manager that the new WT enforce the newest agency alternative otherwise which includes partners, beneficiaries, otherwise citizens which might be indirect beneficiaries or people who own the new WT.

- A different mate will get complete a questionnaire 8804-C to a collaboration any moment within the partnership’s seasons and you will before the partnership’s submitting of the Form 8804.

- We ACH for the services the worth of the brand new circulate outs as a result of the possessions.

- A good withholding agent can be accountable for withholding in the event the a good international person transmits a great USRPI to the agent, or if it’s a corporation, relationship, trust, or property you to distributes a great USRPI so you can a stockholder, partner, or recipient which is a foreign individual.

SBNRI try pioneering the new facility from trouble-totally free NRI Savings account Beginning the place you just need to upload the required files and you can complete the internet form and also the attested originals would be acquired from the target abroad. (i) Create people financing to be used to own charity intentions in the consultation to the depositors. Provided that the choice to receive the attention on the readiness which have compounding impact shall vest on the depositor. Arranged Industrial Banks will maybe not draw any type of lien, direct otherwise secondary, up against NRE saving deposits.

How do all of our prices compare to to your-campus housing cost?

The fresh property owner-citizen lease should include the brand new legal rights and you can requirements from both the property manager and also the citizen. It should establish the degree of the new put, where the property owner holds deposits and also the count that will rating withheld at the bottom of your rent. “As the DepositCloud offers coming citizens all of the available substitute for satisfy our very own put, as well as the state’s legislative standards, the necessity for the house or property group to manage which, is eliminated! Branching all defense put government away from the possessions because the book is approved and you will pending circulate-inside, lets us make sure we’re certified which have courtroom criteria. Most of these loan providers who’ve came back with mortgages to have customers with an excellent 5% put can be just accessible via a mediator, otherwise are merely providing the 95% mortgage items through intermediaries. Currently, all lenders offering mortgage issues to own people which have a 5% deposit want one another candidates getting Uk residents and most require one to have long lasting liberties to live in great britain.

No citizen three dimensional 5 deposit put incentives are a great solution to express the country out of web based casinos with no monetary risk. They give participants that have the opportunity to test the fresh the fresh video game and you will systems, potentially winnings real cash, appreciate some advertisements as opposed to to make a primary put. By knowing the terms and conditions, selecting the most appropriate incentives, and you can controlling your bankroll efficiently, you could potentially optimize the advantages of such also offers. Several of our very own clients, facing our very own suggestions, specifically agree with the citizen on paper on the rent agreement that property owner should retain all of the interest to the places. These types of staunch believers in the independence from deal believe when the the people have arrangement, it needs to be acceptance and does not getting confronted. Unfortuitously, Fl rules doesn’t draw clear lines out of when and where we can disperse away from Property manager/Tenant Act and you can contractually commit to a thing that is not specifically allowed along the way.

In case your WT are a good grantor faith having You.S. owners, the fresh WT is required to document Setting 3520-A good, and provide statements in order to a great U.S. proprietor, along with for each You.S. recipient who’s not a manager and you can gets a distribution. If your WT are an FFI, it is needed to statement each of the You.S. membership (or You.S. reportable profile when the a reporting Design step one FFI) to your Mode 8966 in line with the FATCA criteria or perhaps the requirements from a keen IGA. Almost every other documents may be required to claim an exception away from, or a lower rates out of, chapter step three withholding on the pay money for private functions.

An excellent nonresident alien susceptible to wage withholding have to allow the workplace a finished Form W-cuatro to allow the brand new boss to find simply how much income tax so you can withhold. The fresh withholding laws you to definitely connect with payments so you can foreign persons basically take precedence more than any withholding regulations who would affect withdrawals away from qualified agreements and other qualified later years preparations. If a foreign business is actually at the mercy of branch payouts tax to have one tax seasons, withholding is not required to your one dividends paid by the corporation out of their income and you will winnings for this income tax year. Returns could be at the mercy of withholding when they due to people income and you will earnings if the branch payouts taxation is banned because of the a tax pact. A treaty could possibly get allow less rate or different to possess interest paid off by the a residential firm to a controlling foreign firm. The interest can be on the any type of personal debt, in addition to discover otherwise unsecured accounts payable, notes, certificates, securities, and other indications out of indebtedness.

Withholding Agent

Money to specific persons and you will payments of contingent interest do not be considered while the profile interest. You should withhold during the statutory price to the for example money unless of course some other exception, such as an excellent treaty supply, enforce and you may withholding under section cuatro will not use. If you fail to dictate the new taxable matter, you should keep back to your whole amount of new thing discount accumulated on the date from matter before the go out away from redemption (otherwise sale or replace, if the at the mercy of section step 3 withholding otherwise an excellent withholdable fee) computed based on the of late authored Club. Particular businesses sell issues thanks to a good multilevel selling arrangement, in a manner that a higher-level provider, who’s sponsored less-level distributor, is permitted a payment in the team based on certain points of the down-level supplier.

The fresh skills within the things (3) and you can (4) are not active for many who (or the certified alternative) provides genuine degree, otherwise discovered a notice from a realtor (otherwise replacement), that they are untrue. And also this relates to the new certified substitute’s report below product (4). If you cannot provide an entire and you will best Mode 8805 every single companion when due (as well as extensions), a punishment can be implemented. The amount of the new punishment hinges on once you supply the best Form 8805. The fresh punishment for each Function 8805 is generally like the new penalty to possess not bringing a correct and you will over Function 1042-S.

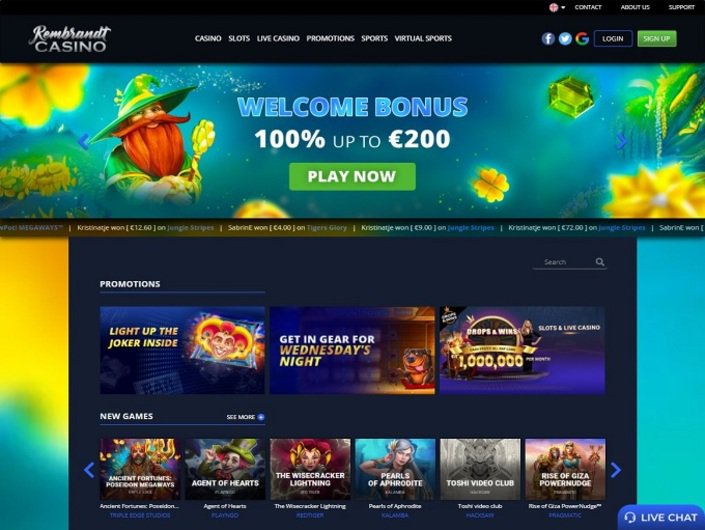

After mindful comment, I deemed that 2023-put-out Ybets Casino brings a safe betting web site geared towards both casino betting and you will sports betting that have cryptocurrency. The standout acceptance added bonus is just one of the best offered, drawing in many new people and permitting them to discuss 6,000 online game of 50 studios with an enthusiastic state-of-the-art money. Florida law says when the fresh deposit money is kept in the a destination affect account, the house or property movie director have a couple possibilities when dealing with the interest. Of several loan providers enable it to be potential homebuyers in order to enhance its put which have talented money from family members. Yet not, these types of merchandise typically wanted files to ensure they are maybe not addressed while the finance to be paid. A good. If the a citizen or traffic of the resident cause damage to the house that’s not sensed typical don, the new landlord is withhold the entire or an element of the security put to fix one destroy.