Blogs

Almost every other common contactless fee alternatives increasing try cellular programs and you may purses. These are applications held for the cellphones allowing of many progressive cell phones when deciding to take the place from a cards otherwise debit cards. Merely carry it inside two to four in away from a cards reader, and the transaction will cover itself.

Get a smart debit cards – and pay with your mobile phone around the world: casino Michelangelo

You’ve most likely seen a digital Bag in action, or have the app on your cellular phone, but do you have the skills for action? Electronic Purses provide comfort by allowing you to use your cellular telephone or other electronic gadgets to pay for one thing as opposed to bucks otherwise your synthetic credit card. Forgotten a credit card percentage isn’t greatest, however, if it occurs, the results trust just how late you’re.

What credit rating do you want to qualify for a telephone package?

- Including Square and LevelUp, merchants are recharged apartment fees per transaction.

- Tap to expend is an easy and you will safe way to make in-people sales, and contactless payments can be more secure than using a simple mastercard reader.

- And once you start to expend making use of your cellular phone too, you’ll disregard it was previously needed to hold the wallet or rifle because of fee notes within the a store or bistro.

- You can normally discover the mail-within the target on line, or you can call to get it.

- Your standard cards look first, but you can scroll off and select other credit.

Even though this method just allows placing rather than withdrawing, it has their gambling enterprise deals separate from the family savings. When you yourself have a good prepaid cell phone and wish to try this means, their deposit will be quickly deducted from the prepaid service borrowing. As with any most other purchase, you’ll be able to secure benefits on your own monthly mobile expenses that with an excellent perks charge card to cover your own statement. If you know and that card to use, you can get as much as 5% straight back on your own smartphone bill per month, and people advantages accumulates through the years. You can be eligible for all of these cards even though you do not very own a vintage business. Otherwise, you could consider bucks-right back credit cards that don’t restrict its high-money benefits to particular spending categories.

How will you earn advantages on your portable expenses?

To make a cost, electronic purses use your mobile phone’s wireless features in addition to Wi-Fi, Wireless and magnetized indicators. The brand new magnetized signals hook up thanks to something called Near career interaction (NFC). Such indicators transmitted the borrowing otherwise debit credit guidance from the mobile phone in order to a tool the merchant brings, that is designed to discover this study. Two of the top mobile purses being used today is actually Yahoo Spend and Fruit Shell out—characteristics designed for Ios and android mobile phones, correspondingly. These types of services form by the hooking up a card or debit cards from your favorite bank to your mobile phone’s commission platform.

Fruit Pay performs with the Apple Handbag app, which you are able to see of all Fruit devices, like the iphone 3gs, Apple Watch, and you will Mac computer computers. Just after loading the Apple Purse app which have one or more credit notes, you need to use Apple Shell out to complete purchases during the point-of-product sales terminals in lot of dinner, super markets, and stores. Have a tendency to, you will have an indicator showing your terminal accepts Fruit Shell out or tap-to-spend handmade cards. Your own smartphone might be a convenient way to pay money for items and you will functions wherever you are, enabling you to log off dollars and you may playing cards trailing. From giving money in order to members of the family when you split a restaurant expenses, to using your own electronic handbag in the a market, their mobile phone tends to make cost management much easier. It payment approach offers a safe treatment for make repayments using mobile debts.

We provide of several simpler implies on how to shell out the costs – on the web, with the My casino Michelangelo Optimum app, by the cell phone, myself, otherwise by the send. Assume an installment note text message, that will let you know of your own equilibrium, account amount, and you will due date. In case your membership have a credit harmony, the brand new indication won’t be sent.

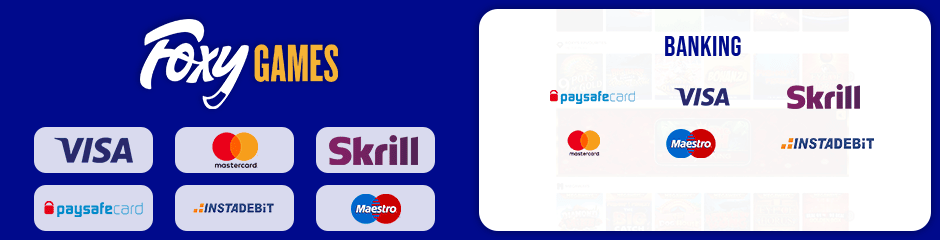

Get the Comments & Documents hook up regarding the Membership Government section, then find the Paperless Options link. Thus, we hope, anybody can notice that when it comes to mobile ports, deposit by your cellular phone statement is a great means to fix put money to your account. There are many reasons for this, on the non-existent costs all the way through for the highest levels of shelter, and it most couldn’t be more simpler. If you want to get the best pay-by-cellular gambling enterprise site, we’ve assessed most of them on this web site to bring you the best. So here are a few our number and read from the report on the best cellular ports internet sites. Their monthly payment would be immediately deducted out of your checking account or recharged for the debit/bank card every month.

You could remain an equilibrium on your PayPal account and you will use it to own orders. PayPal Borrowing from the bank is a rotating line of credit which allows you a lot more time for you to pay back purchases but charge an annual percentage rate if you hold a balance. But if you pay only your lowest every month, it will set you back you a lot inside the interest throughout the years. We post cardholders all sorts of legal notices, and notices out of grows or decrease inside the lines of credit, privacy observes, account reputation and you can comments. Already, we could render these courtroom notices, along with comments, electronically. We are working for the having the ability to render many of these judge notices digitally.

Rewards credit cards shave step one% or higher off the cost of repeating expenses including cellular telephone agreements. Should your cellular vendor doesn’t tack for the a lot more charge to invest which have credit cards, that is an opportunity to generate income back otherwise travelling perks. In addition to this, choose a card one produces dos% right back to the all the sales, or a cards that offers a high lingering advantages rates to own mobile phone bills. LevelUp are a mobile costs processor with more capability than any out of another alternatives we’ve viewed.

But not, the credit cards information that individuals upload could have been composed and you may examined because of the professionals who discover these things inside out. I merely highly recommend points we both explore ourselves otherwise promote. This site doesn’t come with all of the credit card companies or the available charge card offers that are in the business. See our advertisements rules right here in which i checklist advertisers that individuals work with, and just how i return. You can utilize Google Shell out since the an electronic purse to own everyday transactions, away from P2P transfers to help you within the-individual sales and online costs.

Handmade cards always will let you install automatic costs, and you’ll have some alternatives. You could potentially choose to spend the money for minimum count, a set number if you’re also carrying a balance (for example $a hundred thirty days), or to spend in full. Look at the commission section on your credit’s website otherwise software and you will follow the encourages to arrange automated payments. You could make use of your electronic handbag to cover purchases online from the looking it as a payment alternative during the checkout. The newest app can also be transfer your own advice, saving you from being required to by hand go into the credit count. Knowing how to utilize your charge card on your cellular telephone is make shopping more convenient and sustain you against being required to build exposure to the newest credit terminal.

- Sure, simply visit any During the&T store location to shell out their costs individually.

- Toyota Economic Services is an assistance mark employed by Toyota System Borrowing Firm (TMCC) and Toyota Car insurance policies Services, Inc. (TMIS) as well as subsidiaries.

- Running a business and you will Economics News media from Boston College.

- If you decide to channel your everyday Cash in order to Deals, you have anytime entry to your bank account facts and also the attention you’ve acquired.

- For the journey termination and you may interruption insurance coverage advantage of The new Platinum Card of Western Display, eligibility and you may work with top may differ by the cards.

- Advantages are travel reduce exposure, purchase security, as much as $one hundred to cover the Global Entryway, TSA PreCheck, otherwise NEXUS application payment, and primary automobile leasing insurance policies.

- Certain put choices have certain laws and regulations surrounding him or her that don’t allow it to be bonuses becoming said.

Cellphones including the iphone 3gs XR Maximum and you may Universe S9 will always be become borrowing from the bank appeared. Since they’re highest-end gizmos the likelihood of bringing refused due to less than perfect credit otherwise an enthusiastic IVA increase. FinanceBuzz are an educational webpages that give tips, advice, and you will advice in order to make monetary decisions. We try to provide upwards-to-day guidance, however, create no warranties about your accuracy your guidance. At some point, you are accountable for debt behavior. FinanceBuzz is not a lending institution and does not render borrowing from the bank notes and other financial products.

Relax knowing, that with Rectangular Digital Terminal you might render you to definitely self-reliance safely and you may properly. What the law states controlled because of the Consumer Financial Defense Agency says one costs obtained because of the 5 p.m. If you have a binding agreement with a mobile company that works that have Boku you will find that costs to gambling enterprises work with a similar manner in which payments through Text messages do. When you have a cover because you wade SIM out of an excellent served provider, Boku tend to deduct the fresh places that you build having web based casinos from your own latest credit balance.

Each of our reviews provides a huge environmentally friendly ‘Play HERE’ option which will take you directly to the brand new gambling establishment. Should you get here, merely sign in an account from the filling up the required advice. Use online in under a few moments and you may be considered for more leasing borrowing than just you would expect. Request to expend over time to your big posts, or just pay entirely to your shorter some thing.

Is actually one of the prebuilt integrations for the application your already have fun with otherwise build your own knowledge playing with our APIs. Banking features are offered from the Square Economic Characteristics, Inc. or Sutton Lender; Professionals FDIC. Just what started that have payments features turned a mission to switch just how enterprises work with.

Mobile producers including Apple and you will Samsung provide insurance policy one new iphone 4 otherwise Samsung device associate can find. On the cellular phone protection benefit of the fresh Delta SkyMiles Platinum Western Express Credit, qualification and you will work with peak may differ from the card. Thus cardholders of your own Twice Bucks card often today earn dos% on each buy that have unlimited 1% money back once you get, and an additional 1% because you buy those people orders. The newest Wells Fargo Autograph Card also offers higher 3x incentive points and you can mobile phone protection and no annual payment. As well, for those who never ever remove or destroy your own cell phone, you’re better off acquiring much more mastercard rewards and you can giving up cellular phone insurance.